Delcath Update (DCTH-$4.66)

I'm here to tell you I was a pig. And I strongly believe the only way to make long-term returns in our business that are superior is by being a pig.- Stan Druckenmiller

I originally published a report on Delcath on December 19, 2022 and then subsequently issued an update on April 2, 2023. I have also written about Delcath on my Twitter account (guy jud@jud_guy).

On August 14th, the US Food and Drug Administration (FDA) approved HEPZATO KIT (melphalan/Hepatic Delivery System) as a liver-directed treatment for adult patients with metastatic uveal melanoma (mUM), a rare form of cancer that affects melanocytes in the eye. In the United States and Europe, respectively there are approximately 1k and 2500 sufferers each year where the cancer spreads (metastasizes) to the liver. There is currently no cure and prior to HEPZATO approval, the only other approved treatment was KIMMTRAK, which is priced at an average of $790k per patient, with efficacy (OS and ORR) comparable to HEPZATO. KIMMTRAK is easier to administer (via weekly 20- minute IV infusion at one of KIMMTRAK’s 187 specialized infusion center partners) than HEPZATO ( a maximum of 6 inpatient procedures at a cancer center hospital whose team has been specially trained to use HEPZATO). KIMMTRAK is approved for 45% of the mUM patient population (compared to the 80% who will be eligible to use HEPZATO); has captured an estimated 40% share of eligible patients within 12 months; and reported $41.7 million in Q2 2023 US sales ($167M annualized revenue).

There is angst among some investors that HEPZATO will have a disappointing launch compared to KIMMTRAK, but Delcath has been very clear that the launch will in fact be slower since a hospital cancer center has to become a Delcath partner and a 3-member team has to become trained in how to perform the procedure. Furthermore, a patient will have to travel to the cancer center for what will be an outpatient procedure. At launch, there will likely only be 3-5 trained hospital sites so at least initially some patients will absolutely have to travel some distance. The company currently has 3 trained hospital partners; plans to have 3-5 when the Q4 launch begins; 10 by mid year; 15 by FY24 year end; and 25 centers ultimately.

I assume pricing is $150k per procedure, (apples-to-apples HEPZATO would cost $600k annually while KIMMTRACK annual pricing is $790k), and an initial treatment cadence like 1/month or every 2 weeks to start. This produces a revenue estimate of $45.0-$50.0 mill for the first year – but exiting at a $60-70 mill run rate and growing to $100 mill in year 2. At full maturity, assuming 25 centers @ 2 procedures a week, Delcath could do $90 mill a quarter in mUM in US alone.

There is some uncertainty as to what extent KIMMTRACK and HEPZATO will compete against each other. Delcath management believes HEPZATO is more of a complement than competitor to KIMMTRACK and has pointed out that some doctors who have been treating patients at Delcath’s 3 initial Early Access Partner sites have used HEPZATO as a 1st line stand alone treatment, 1st line treatment for those intending to receive KIMMTRAK, as 2nd line treatment, and as a 3rd line palliative treatment. KIMMTRAK is not chemotherapy or radiation therapy—it is an immunotherapy† treatment designed to mobilize and activate the T cells of the immune system to fight uveal melanoma tumor cells. HEPZATO, as previously stated, acts in a totally different fashion, safely saturating the liver with chemotherapy. Multiple studies support that early and effective management of liver disease can improve survival for those diagnosed with metastatic uveal melanoma and liver-directed therapy is a core part of existing NCCN guidelines for metastatic uveal melanoma patients. This supports the notion that KIMMTRAK and HEPZATO will often be used together.

Some Delcath detractors have cited historically poor Europe sales as another reason to question the value of HEPZATO. Delcath received a CE Mark in Europe in 2012. The procedure is currently available in 23 centers in 4 countries, with the majority of procedures done in Germany and England. Over 1300 procedures have been done in Europe (approximately 100 per year). However, because HEPZATO never received FDA approval, achieving reimbursement has been very challenging. Reimbursement is available in Germany based on a hospital special request and in Great Britain on a limited basis. With FDA approval, broader reimbursement in Europe should follow The current business is also primarily being driven by investigator word of mouth. The company has a very limited team in place with only a single account manager in England . With the FDA approval and recent capital raise, Delcath is now positioned to seek national reimbursement in European countries and add account managers so the business can begin to scale. I estimate that KIMMTRAK is priced approximately 33% lower in England ($12k/vial) than in the United States. Assuming HEPZATO European pricing is similarly discounted by 33%; the 100 annual procedure run rate represents $10.0 m in potential additional revenues. Of course, with actual marketing in place, the annual revenue opportunity is significantly higher.

I believe based solely on the mUM opportunity, investors are vastly undervaluing DCTH stock. FY24 and FY25 revenues from mUM could realistically approach $50.0 m and $100.0 m, respectively. The model fully mature could easily generate several hundred million dollars in revenues annually The infrastructure necessary to develop the business is also modest, given there are likely a maximum of 25-30 cancer center partners and there’s probably 90 to 100 oncologists that have any kind of volume of uveal melanoma outside of 1 or 2. Delcath anticipates one hired rep can cover 30 medical oncologists.

Finally, given HEPZATO is a delivery platform, not a drug, it will never face a generic alternative in the same way a drug does.

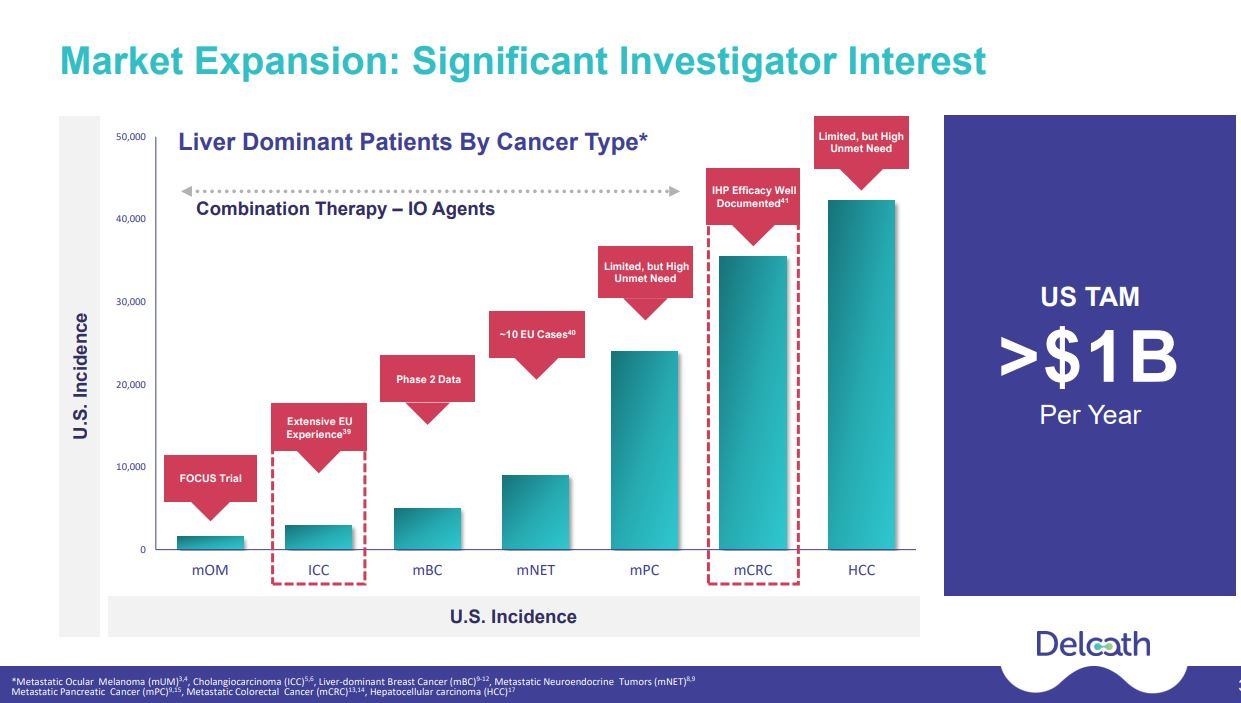

I believe investors will begin to understand that HEPZATO is a leverageable platform for delivering high-dose chemotherapy (or potentially other medicines) to the liver with the goal of minimizing broader exposure to a patient and reducing harmful side effects. Metastatic uveal melanoma represents well under 5% of the patient population whose cancers become liver dominant. HEPZATO benefits mUM patients by addressing spread to the liver. Logically, HEPZATO should also help patients who suffer other types of liver-dominant cancers. The following slide illustrates the significant market opportunity beyond mUM

Over 1,300 PHP procedures have been performed in Europe with Delcath’s device treating a wide range of liver cancers beyond mUM. Some of these studies focused on intrahepatic cholangiocarcinoma (“ICC”, 8k patients). Delcath had started to investigate ICC, however, they had to pause starting a trial due to a lack of funding. ICC is a larger market than metastatic ocular melanoma and has some similarities in that many of these patients are treated at special centers and there is a high unmet need especially for patients who failed first-line therapy. Delcath has already created a series of planned advisory boards review with protocols for both ICC and metastatic colorectal cancers (“CRC”, 30k patients)) trials. Given the recent capital raise, Delcath will likely initiate ICC trials in 1H24 and then follow with one or more CRC trials.

As I also discussed in my initiation report, combination therapy is a radical approach since while liver failure due to hepatic (relating to the liver) metastatis is the leading direct cost of death for mUM patients, in other types of cancers that frequently metastasize in the liver (such as colorectal), extrahepatic (located or occurring outside the liver) metastasis do occur in treatment which HEPZATO alone can not effectively treat, while systemic immunotherapy has very limited efficacy on liver metastasis. Logically, combining therapies may lead to better control of both hepatic and extrahepatic disease. The ongoing CHOPIN trial study is evaluating the safety and potential synergistic effects of systemic immunotherapy (ipilimumab plus nivolumab or “IPI+NIVO”) when combined with HEPZATO treatment in mUM patients. In January 2023, updated safety and efficacy results from the Phase 1b portion of the trial showed that combining HEPZATO with IPI/NIVO was safe in a small cohort of patients with mUM at a dose of IPI 1 mg/kg and NIVO 3 mg/kg. The Phase 1b portion of the trial enrolled seven patients each of which were treated with two courses of PHP combined with four courses IPI+NIVO. Data previously presented in June 2022 was excellent: Best Overall Response included 1 complete response, 5 partial responses and 1 stable disease accounting for an Objective Response Rate of 85.7% and a Disease Control Rate of 100%. At the cut-off date of November 15, 2022, the median follow-up was 29.1 months (range 8.9 – 30.2), the median PFS (“Progression Free Survival”) was 29.1 months (95% CI 11.9 – 46.3) and the median duration of response was 27.1 months (range 7.4 –28.5). All patients were still alive as of the January 2023 update. Phase 2 of the trial will include another 76 patients (38 per arm). The study was 50% enrolled as of January 2023. On the Q1 2023 CC, management stated that “independent investigators conducting that study have informed us that they are on track to publish a pre-planned interim analysis by the end of this year. The analysis will include 40 of the planned 76 randomized patients, comparing percutaneous hepatic perfusion with Chemosat alone with percutaneous hepatic perfusion with Chemosat plus ipilimumab and nivolumab.”

Finally, I wanted to address the warrants, dilution, and share count. Delcath management deserves enormous credit for reviving a company that had been left for dead by most investors. After receiving a complete response letter (CRL) in 2013, the company’s stock crashed and was ultimately de-listed. The company got back on track in 2018 by redesigning its trial (called “FOCUS”) to be a single-arm study and developing different filtering (Gen 2 filter) to address past safety issues. The CEO, Gerard Michel, joined Delcath in October 2020. He left a comfortable CFO position at Vericel to lead Delcath. He has operated the company with virtually no capital, through Covid, and under the cloud of mistakes made by the previous leadership. Despite excellent FOCUS trial results, a misinformed blogger cast aspersion on the data and further insinuated that the company was devious in its presentation of the data. These accusations, coupled with an impossible microcap healthcare/biotech investing market, precluded a ripe opportunity to raise capital following the release of FOCUS in March 2021. In hindsight, perhaps, the company should have sold shares even after the initial decline, but the data was positive, not negative, and the indecision to raise capital understandable. Arguably, also, the company should have (and probably still should) change its name given how poorly the shareholders were treated BEFORE the company began to turn things around. But that is the past. The company did a few small capital raises in the past 18 months and to his credit, Mr. Michel participated in each deal with his own money. The lack of funds slowed the approval progression for HEPZATO; prevented the company from investigating new markets; and left European marketing and reimbursement in a state of limbo. When the company (after several frustrating delays mainly due to inattention from third party CROs) finally did announce that it had filed for HEPZATO approval, I wrote in my April 2023 update the following:

“The $85m cap raise is dilutive. Assuming warrants are converted, the deal will add 19.5 m shares @ avg $4.35, but the company desperately needed $ and should not need another round for the foreseeable future. It is also encouraging that several solid healthcare HFs did due diligence and are now invested. Of course, if the FDA rejects HEPZATO, the stock price would be severely impacted, but I believe the odds of approval are closer to 90% given the safety has consistently been good; that the primary endpoint ORR is above the predefined threshold for success; and the survival data metrics have been comparable to the aforementioned approved and hugely successful KIMMTRACK.”

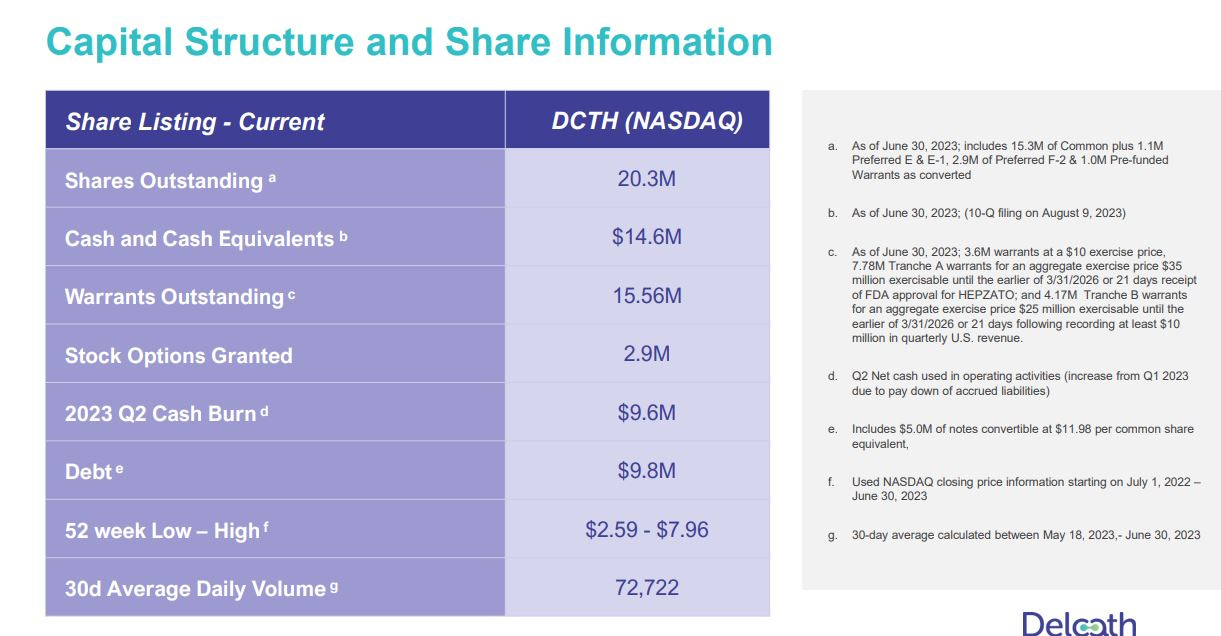

Following the August 14th approval and even through the September 1st PR that all the Tranche A warrants have been exercised, I was extremely surprised that investors actually were discussing the warrants as a new risk factor. The terms of the offering had already been released and discussed months earlier so there was absolutely no new revelations or insights. The following table, released in the Delcath Powerpoint presentation, shows the capital structure. In all, assuming all warrants are executed, the fully diluted share count is 38.7 m shares. Adding the $35.0 m cash raised from the recently converted warrants, there would be $49.6 m in cash on the balance sheet (of course not factoring cash burn this Q). Once Tranche B is exercised (21 days following at least $10.0 m in quarterly sales), an additional $25 m in cash will be raised and the 3.6 m warrants@$10 and and 2.9 m stock options are additional sources of capital (which I have already included in the fully diluted share count). Bottom line, the $85.0 m capital raise IS IN FACT dilutive, but it also is well-known and was necessary to allow the company to fund the HEPZATO launch as well as undertake new trials and solidify positioning in Europe. Notwithstanding the dilution, the stock is still significantly under-valued based SOLELY on mUM, which is the SMALLEST market HEPZATO will target.

To conclude, I believe Delcath is a better investment opportunity today than when I initially published given HEPZATO is now the only FDA approved platform to safely saturate the liver with chemotherapy for mUM patients. Given there are multiple liver dominant cancers and also that the prospect of HEPZATO being combined with front line systemic cancer drugs is promising, there are multiple shots on goal for the stock price to achieve substantial gains over the next 24 months.

I am LONG Delcath (DCTH) so consider that I am biased and make your own investment decisions.